Stimulus Debit Cards Have Arrived. Here's What to Know About the Fees:

June 3, 2020

By Joel Christophersen

By Joel Christophersen

V.P of Retail Banking The government has sent out nearly 150 million Economic Impact Payments (a.k.a. coronavirus stimulus money) to Americans, most of them through direct deposits or paper checks. But a small portion of people — roughly 4 million — are getting their payment a different way: through a prepaid debit card that arrives in the mail.

If you receive one, you can use it online or in person like any normal debit card, at any place that accepts Visa®. However, using the card might not be completely free. Keep reading, to learn how to use your debit card carefully and avoid possible charges and fees.

Who gets an EIP Debit Card?

According to the U.S. Treasury, EIP Debit Cards are going to qualifying Americans who 1) don't have their Bank account information on hand with the IRS, and 2) have had their tax return processed at one of two service centers: in Andover, Mass. or Austin, Texas. We know this group includes a number of South Dakotans, because we've already had customers stop by Security National Bank branches with their new cards.

The IRS says that at this time, you cannot specifically ask for an EIP Debit Card. Instead, recipients are decided upon by the Bureau of the Fiscal Service. For more information, visit the official stimulus debit card website at EIPcard.com.

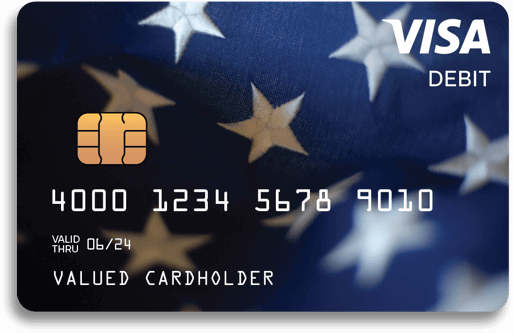

What will the card look like?

The card will arrive in a plain envelope labeled “Money Network Cardholder Services.” That's all the envelope will say, so be careful not to toss it out with the junk mail. Open the envelope and you'll find your card with the Visa® name on the front. Flip it over, and on the back of the card you'll see the name MetaBank® (this is the official financial agent of the U.S. Treasury). The card will also come with instructions on how to activate it and set your PIN number.

The card's design will look like the picture below:

Source: U.S. Treasury

» Beware of scams

If your card doesn't look like this, or doesn't come in a plain envelope from “Money Network Cardholder Services,” it is a scam and NOT a real Economic Impact Payment. In this case, throw the card in the trash and do not respond to any contact information that came with the card. If you have any questions regarding a suspicious card, contact us online or call the SNB customer service center.

And remember: unless you ask for assistance, the government will never call, text, email or ask you to click on a link they send to activate your card or get your stimulus money. Anyone who does is a scammer.

» Activating your card

To activate your card, call 1-800-240-8100. You'll be asked to provide your name, address and Social Security Number. Then, you'll be asked to create a 4-digit PIN number. Write it down, keep it somewhere safe and don't forget it. After you activate your card, sign the back on the white strip and you'll be able to use it anywhere that accepts Visa®.

» What if I lost my card or threw it away?

Don't worry, no one would blame you if you tossed the card thinking it was a credit card solicitation or a scam.

To replace a lost or stolen EIP Debit Card: Call 1-800-240-8100, press "2" when prompted for a lost or stolen card, and enter the last six digits of your Social Security Number. The first replacement card is free, although there will be charges if you want priority shipping (more on that below).

Watch out for extra fees and charges

Though the EIP Debit Card is mostly free, there are a few fees and charges you should be aware of:

» ATM Fees ($2.00 or more)

According to the official EIP cardholder agreement, cash withdrawals are free at ATMs — but only if they're at an "In Network" machine. You can find these using the ATM Locator on the official EIP Card website. Unfortunately, around Siouxland, these “in network” machines are few and far between.

If you decide to use a different “out-of-network” ATM, you're only allowed one free withdrawal for up to $1,000. And even though this transaction is technically “free” on the card's end, you'll probably still get dinged with an ATM surcharge from the machine itself. This usually costs a few dollars.

Then for every additional withdrawal you make from an out-of-network ATM, you'll get charged an additional $2.00 fee — on top of the ATM surcharge! And since there is a $1,000 per-day withdrawal limit on the card, and the standard stimulus payment is $1,200 (more if you're married or have kids), you're going to have to take multiple trips to the ATM if you want to take out all of your cash.

» Balance Inquiry Fees ($0.25)

Beware: you will get charged 25 cents for simply checking your balance at an ATM, even you don't withdraw any money. This includes in-network and out-of-network ATMs. To check your balance for free, you have to register your card at the official EIPCard.com website, then log in to your new user account. Or, you can call the customer service line at 1-800-240-8100 and request your balance there.

» Card Replacement Fees ($24.50 for priority shipping)

The U.S. Treasury has waived the fee for your first replacement card, as long as you're willing to wait the normal 7-10 business days for it to arrive in the mail. If you want your card faster, it'll cost $24.50 for expedited shipping (4-7 business days). If your card gets lost or stolen again, getting a new one will cost you a $7.50 replacement fee, plus $17.00 for faster shipping.

How to avoid the fees and charges

Here are a few ways to get the most out of your stimulus payment, without having to pay any extra fees or surcharges:

» Deposit to your Bank account

There are no fees if you want to transfer your funds directly to your Bank account, which gives you the double benefit of avoiding extra charges and eliminating the possibility of losing your debit card.

To make an online deposit:

Register as a new user at the official EIPCard.com website. Once you've created a new account, you can log in and transfer the balance electronically into your SNB account — at no charge. All you need is your account number and the SNB routing number.

To make a one-time deposit in person:

You also have the option make a one-time, fee-free “over-the-counter” cash withdrawal. To do this, go to your nearest SNB branch location and hand the teller your card for swiping. You'll get your cash at no extra fee — and you can either pocket the money or deposit it directly into your account. The withdrawal limit in this case is $2,500 — and if you come back to make another withdrawal with your EIP card, MetaBank® will charge you a $5.00 fee each additional time (no matter where you try it). So if you can swing it, you might as well get all of your money at once!

» Use at stores (like any debit card)

Instead of depositing your funds, you can simply use the EIP Debit Card to shop anywhere Visa® Debit Cards are accepted: in-store, online or by phone. You can also get cash back at stores when you make a purchase at the register (depending on the store's policy).

» Pay your bills with the card

Remember, you can use the EIP card like any debit card — meaning you can also use the card number to pay your regular bills. Just make sure you have enough funds to cover the entire bill, otherwise your payment might be declined or only partially authorized.

Was this article helpful?

We want to provide solutions that matter, when you need them most. Keep up with the latest updates on our Coronavirus Information Page.