View your credit score, anytime.

You now have instant access to view your live credit score, whenever you log into the SNB Mobile App or online banking account.

This is a free service offered by Security National Bank to help you understand your current credit score, give access to your full credit report, provide credit monitoring alerts, and simulate and learn ways to improve your score.

How do I get my score?

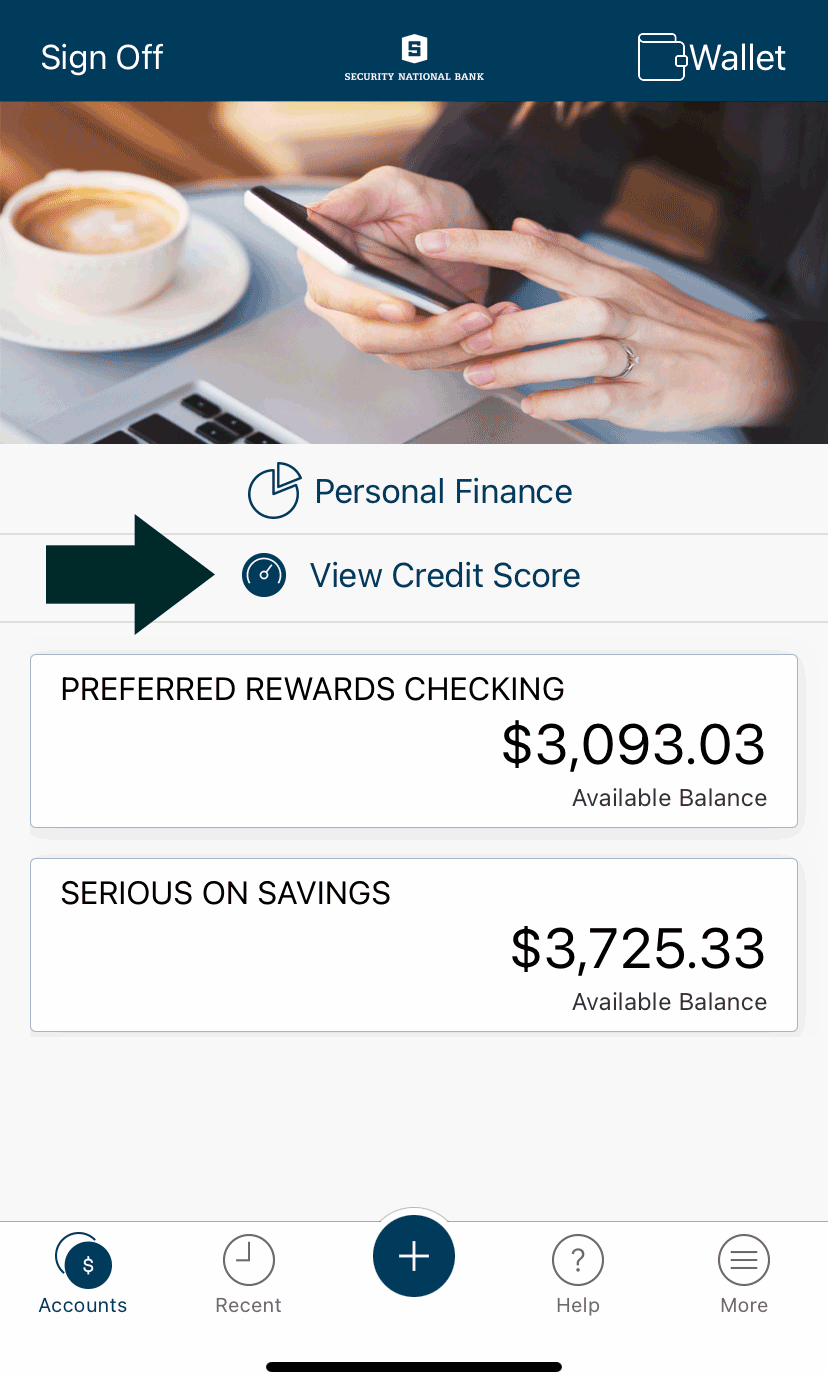

Activate Credit Score on your app

- Download the SNB Mobile App and log into your profile.

- Tap the “View Credit Score” tab in your account menu.

- Enroll. Sign up and you're finished! Now, your score will be available anytime you log into the App

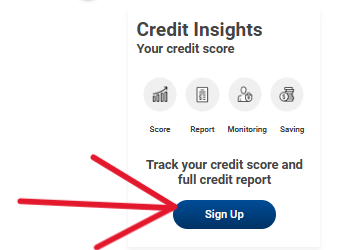

Or, activate Credit Score through online banking.

- Log into your online banking account.

- Click the "Sign Up" button on the Credit Insights section.

- Enroll. Sign up and you're finished! Now, your score will be available anytime you log into online banking.

Credit Score features

Take advantage of all the Credit Score features that are now built into our online banking and mobile banking apps.

See your live score.

See your live score.

Update or refresh your score anytime you log in, for absolutely free. Don't worry, this is only a “soft inquiry” — meaning you can check your score as many times as you'd like without harming your credit.

Get free monitoring and alerts.

Get free monitoring and alerts.

Safeguard against fraud by setting up an alert that will notify you anytime your credit file changes.

Understand your score.

Understand your score.

Learn about how your credit is calculated, and what factors are most affecting your current score.

Learn how to improve your score.

Learn how to improve your score.

Get personalized money saving recommendations, and use the score simulator to see how certain actions will impact your rating.

Frequently asked questions

Here is a list of Frequently Asked Questions (FAQs) and answers about the Credit Score feature on the SNB Mobile App.

What does the Credit Score feature do?

A: Credit Score is a program, built into the SNB Mobile App and online banking tool, that helps you stay on top of your credit. You get your latest credit score and report, an understanding of key factors that impact the score, and can see the most up-to-date offers that can help reduce your interest costs or lower your monthly payments. With this program, you always know where you stand with your credit and how SNB can help save you money.

What is the Credit Report feature?

A: Credit Report provides you all the information you would find on your credit file including a list of current or previous loans, accounts and credit inquiries. You will also be able to see details on your payment history, credit utilization and public records that show up on your account. Like Credit Score, when you check your credit report, there will be no impact to your score.

What is the Score Simulator tool?

A: The Score Simulator is an interactive tool that allows you to select various actions you may take and see how your score could be affected. Different actions, like paying off a credit card balance might make your score move up or down. Just like every feature on our App, using the simulator does not affect your actual credit score.

Is there a fee?

A: No. The SNB Mobile App is entirely free. The only requirement is that you have an Online Banking account with Security National Bank.

How often is my credit score updated?

A: As long as you regularly access mobile banking, your credit score will be updated every 7 days and displayed within your mobile banking screen. You also have the ability to refresh your credit score and full credit report every 24 hours by clicking “Refresh Score” on the detailed Credit Score Dashboard from within mobile banking.

How is this different from other credit scoring services?

A: We pull your credit profile from TransUnion, one of the three major credit reporting bureaus, and use VantageScore 3.0, a credit scoring model developed collaboratively by the three major credit bureaus: Equifax, Experian, and TransUnion. This model seeks to make score information more uniform between the three bureaus to provide consumers a better picture of their credit health.

Why do credit scores differ?

A: There are three major credit-reporting bureaus—Equifax, Experian and Transunion—and two scoring models—FICO or VantageScore—that determine credit scores. Financial institutions use different bureaus, as well as their own scoring models. Over 200 factors of a credit report may be considered when calculating a score and each model may weigh credit factors differently, so no scoring model is completely identical but should directionally be similar.

Will Security National Bank use Credit Score to make loan decisions?

A: No, Security National Bank uses our own criteria when making final loan decisions. However, the Credit Score tool can show you estimated savings opportunities on new and existing loans. Final rate, term, monthly payment, and other factors will be determined at the time of application.

Will my credit file be shared with Security National Bank?

A: No, Security National Bank does not have access to your credit file, and your report will be distributed from TransUnion into a place where only you can see it, inside your own login profile in the SNB Mobile App or online banking. However, if you would like to share your credit report with your financial institution or any trusted party, you can easily download your credit report by navigating to the “Credit Report” tab and clicking “Download Report”.

How does Credit Score keep my financial information secure?

A: Our SNB Mobile Banking App bank level encryption and security measures to keep your data safe and secure. Your personal information is never shared with or sold to a third party. For more information, view our Privacy Policy.

If SNB doesn't use Credit Score to make loan decisions, why do we offer it?

A: Credit Score can help you manage your credit so when it comes time to borrow for a big-ticket purchase—like buying a home, car or paying for college—you have a clear picture of your credit health and can qualify for the lowest possible interest rate. You’ll also see offers on how you can save money on your new and existing loans with SNB.

What if the info provided by Credit Score appears to be wrong or inaccurate?

A: The Credit Score feature makes its best effort to show you the most relevant information from your credit report. If you think that some of the information is wrong or inaccurate, we encourage you to take advantage of obtaining free credit reports from www.annualcreditreport.com, and then pursuing with each bureau individually. Each bureau has its own process for correcting inaccurate information but every user can “File a Dispute” by clicking on the “Dispute” link within the Credit Report feature. However, The Consumer Financial Protection Bureau website offers step-by-step instructions on how to contact the bureaus and correct errors.

There is a section on the App that features product offers and financial education articles. Why am I seeing this?

A: Based on your Credit Score information, you may receive SNB pre-qualified offers (invitation to apply) on products that may be of interest to you. In most cases, these offers may have lower interest rates than the products you already have or can save you money on your monthly payments. The educational articles are designed to provide helpful tips on how you can manage credit and debt wisely.

Will accessing Credit Score “ding” my credit and potentially lower my score?

A: No. The Credit Score feature in our App is always a “soft inquiry”, which does not affect your credit score. Typically, lenders use “hard inquiries” to make decisions about your credit worthiness when you apply for loans. Those are the types of inquiries that could potentially affect your score.

Does the SNB Mobile App offer credit report monitoring as well?

A: Yes. After you have enrolled in Credit Score for the first time, we will monitor and send email alerts when there’s been a change to your credit profile. When applicable, you can also find these monitoring alerts within your mobile banking account.

How do I change my email address or other personal info?

A: If you access Credit Score through the SNB Mobile App, you are all set and no further action is required from you! Your email address will get updated automatically when you update it within mobile banking. We always encourage you to notify the Bank whenever you have any contact information updates.

Am I able to choose which emails I receive from Credit Score?

A: Yes, you can easily choose when we contact you. Navigate to the “Resources” tab and then under “Profile Settings” you can choose which email notifications you receive. Credit Score sends out three types of emails: Credit Monitoring Alerts, General Messages and Monthly Notices. You will be automatically enrolled in all email communications and can easily unselect the specific email types you wish to not receive.

What if my question isn't on this page?

For more information, or if you have additional questions, contact the Security National Bank customer service center.